A great marketing strategy will bring you lots of customers. That takes a substantial investment of your time and money. Yet, since you have to spend money to grow your company, how can you be sure that it doesn’t cost more to acquire customers than the revenue they bring in? It’s not an impossible task when you calculate customer acquisition costs (CAC). In fact, using this metric is pretty easy.

What exactly is CAC?

CAC is a marketing metric that tells you how much it costs to get each customer over a specific period of time. Marketers track CAC to assess the impact of their content, ads, and other sales costs in relation to the profit margins. The goal is to reduce CAC as much as possible. The less you spend on new customer acquisition, the more profit you make.

Also, CAC calculations shed light on the most effective marketing strategies. That’s good data to inform you where to invest your marketing dollars, especially when your budget is tight.

There’s another reason to track CAC that has little to do with marketing. If you’re looking to attract investors, they’ll be interested in knowing your CAC, and they’ll weigh it when they evaluate your company. In essence, the lower you can keep CAC, it demonstrates to investors that you’re making intentional, data-informed choices about running your company.

Why CAC Can Be Helpful: And Why to Consider it Carefully

Some marketers make the mistake of equating CAC with CPA (cost per acquisition). That’s not quite accurate. Each measures different data. CPA is sometimes referred to as cost per action. CPA is defined as the average cost for every action that occurs.

Another important distinction is that Facebook and other eCommerce platform dashboards don’t figure your CAC. You have to do that on your own.

Exactly how does CAC help you? CAC essentially gives you three things to consider:

- Whether or not you are on the right track with your marketing efforts

- Whether or not you are investing in the right marketing channel(s)

- Whether or not your business is doing actually well

Let’s put it all together! When you understand your CAC, it allows you to make better decisions about how to spend your marketing dollars to maximize your budget’s potential. Also, CAC impacts how quickly your company can grow. It can help you or hurt you.

According to a recent article by ProfitWell that was very well done, we can take stock of why CAC is changing.

The source says that CAC varies a bit for B2B as compared with B2C companies. With so many companies investing in paid ads, ebooks, videos, etc. CAC is up for B2B and B2C businesses — as much as 60% as compared with stats from 5 years ago, with B2B trending slightly higher for CAC.

One exception is the niche B2C companies (technical media, specialized subscription companies) which are seeing CAC of around 25% to 30% over the last 5 years. This is likely because their target audiences are pretty narrow. The B2B industry is seeing a similar trend where CAC is a bit lower for newer companies that are introducing unique products.

ProfitWell also points out that long-standing companies are seeing increases of CAC up to 70%-75% and the increases for newer markets are lower at around 50% over the last 5 years.

New trends around channels are also emerging. Channels that are more labor intensive to produce (think podcasts and videos) gave lower CAC than marketing campaigns such as paid search, display ads, and the like. Entrepreneurs should take special note of these trends as CAC has a major effect on strategic marketing decisions.

CAC in Subscription Businesses Should Take LTV into Account

A common marketing strategy is to offer a freebie to get people in the door. It doesn’t have to be a discount or a coupon, it just needs to be something that consumers believe has value. There are a lot of creative ways to attract prospects:

- Free trials

- Social media posts

- Informative, engaging, or entertaining content

- Discounts

- Time-limited offers

What you want to avoid is the guy that reads the magazine in the store every week and never buys it. How do you steer clear of this pattern?

Answer: By calculating the LTV to CAC ratio.

Why is this important? Because the ratio includes other business expenses like marketing, sales, and customer service. It’s going to tell you whether your business is going gangbusters, going bankrupt, or going steady.

Here’s a tip to take to the bank. Your CAC should be significantly lower than your customer’s LTV. If you’re looking for a benchmark figure of LTV to CAC ratio, most marketers would probably tell you they aim for an LTV that is 3 times as much as the cost of acquiring them.

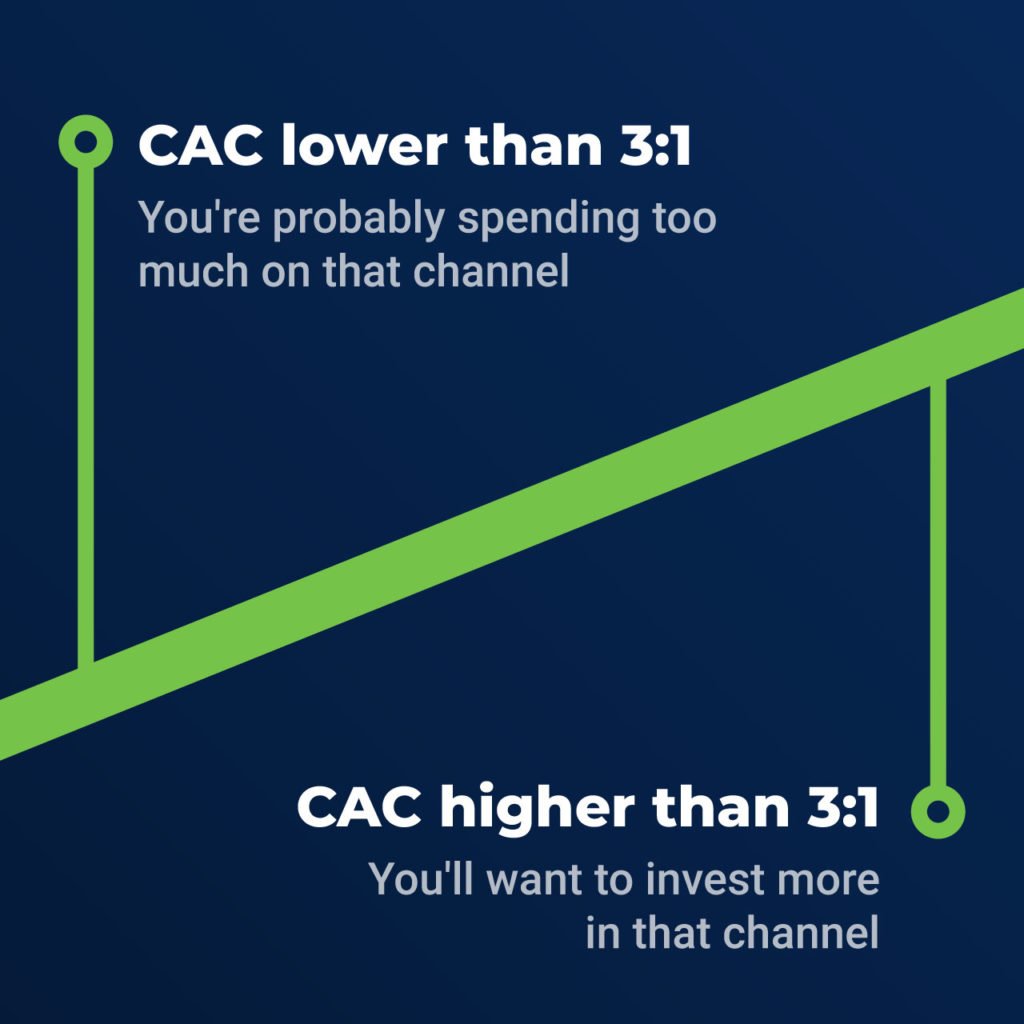

Is your CAC ratio lower than 3:1? You might be spending too much on that particular channel.

Is your CAC ratio higher than 3:1? You might want to invest more in that particular channel so you don’t miss out on valuable opportunities.

With that in mind, let’s look at a practical application of the LTV:CAC ratio as it pertains to a subscription-based model. What makes a subscription-based model different from a company that sells products or services? Customers can leave as quickly as they came. It happens to Netflix and Hellofresh all the time, right?

To keep things simple, let’s say that a customer pays a monthly subscription fee of $10 per month. After 12 months of service, the customer cancels the subscription. The LTV is $120. Your CAC should hover around $12 per customer.

Before you get burned out on math, you should also determine how long it takes to recover your acquisition costs. The general rule of thumb in the marketing playbook is to try to recoup your acquisition costs within the first year.

Moving right along, let’s talk about the freemium business model. Have you ever signed up for a free service just to find that the freebie isn’t all that exciting, but the upgrades that keep flashing at you are pretty tempting — for a price!

This is called a freemium business model and to figure the LTV:CAC ratio, you also have to figure in costs for engineering, research, development, support, and the like, and embed them into the acquisition costs. To improve your CAC ratio on this model, put your creativity cap on, check out your customer feedback, and look for products or features on your customers’ wishlist that you can offer as freebies.

CAC Can Depend on How Much Customer Support Resources One Needs to Invest in Onboarding a New Customer

We’re not done with CAC just yet! For SaaS companies, acquiring a customer isn’t a “one and done.” Rarely does a customer hop on board after seeing one ad or blog article. Often it takes creating awareness, demonstrating value, and providing sales support. The costs of all those activities are part of CAC.

CRMs and the sales and support teams that use them are viable instruments in reducing CAC and acquiring customers. The more successful your marketing programs are, the fewer resources you need to acquire customers, and you won’t waste time on leads that don’t fit your brand.

To that end, you also need to consider that today’s businesses are competing on the customer experience. The costs of a customer success team are also part of CAC. Happy customers tell others and that can also lower your CAC.

CAC Can Fluctuate Around the Different Times of the Year

Lastly, let’s take a page out of the book of companies that have seasonal offerings and how they factor CAC. Think retailers during the holiday rush and landscapers in the spring and fall. Sales are up and so is employment, right?

At best, a bad season can thwart your growth. At its worst, it can threaten your bottom line. Consider that seasonal businesses invest their time and money during the off-season hoping it pays off during the busy season. A lot of risk goes along with that.

Seasonal businesses incorporate three activities into their planning:

- They adjust for the impact of their prime season when doing sales forecasts.

- They set up their sales teams to make big sales during the prime season.

- They continue nurturing leads during the off-season.

There’s no question that sales strategy planning has to be an ongoing process, especially for seasonal businesses. Do you want to stay ahead of the game?

Follow these tips:

- Plan ahead

- Manage your costs

- Nurture leads all year long

- Strengthen customer relationships

- Improve the customer experience

In the long run, it all counts. It all matters.

So, let’s sum things up. Simply put, CAC must be part of your marketing plan. It gives you a temperature on your company’s financial position. If your temperature is good, you simply need to monitor your efforts. If it’s marginal or bad, you have some work to do.

However, you also need to factor in all the variables that affect your CAC, like LTV, the type of industry you’re in, and marketing trends. Currently, the biggest marketing trend is competing on the customer experience.

Don’t get too hung up on exact numbers and throw yourself into analysis paralysis. Start by estimating your CAC value and adjust it as you go.

There you have it! The complete lowdown on CAC (and a little bit about how LTV factors into it). It’s all a numbers game and part of the equation is to keep your CAC low.

Did you find this information about CAC helpful? We hope so because at ClickGUARD we’ve got a lot more to share with you. We have many years of experience helping marketers run successful ad campaigns and understand how to optimize their marketing budgets. If you want to know more about click fraud, we’ve got that covered too. Check out our blog today!